Content Warning: The following post contains a disquisition about option pricing. Readers who are sensitive to this type of content, or who seek salacious details about park residents, decaying infrastructure, baseball bats and large men chasing other men wearing diapers should turn to other posts on this blog.

In the climactic scene of the movie Everything You Wanted to Know About Sex But Were Afraid to Ask, a bunch of spermatozoa stand in the hold of a ship, awaiting the final assault on the target. The scene cuts to the captain’s perspective from the bridge. The viewer sees an attractive young woman facing the camera over dinner at a restaurant. She says, ‘I’m an undergraduate at NYU’. A siren goes off in the hold of the ship and an announcement is made: ‘We’re going in!’ A few airborne troops are launched, to establish a perimeter inside the beachhead. A black spermatazoon, a flake of coal in a snow storm, asks, ‘What the hell am I doing here?’ Then a few of the advance guard come back, ragged and broken, like the messengers in an Aeschylus play, and tell the guys on the landing craft, ‘Turn back! It’s a blow job!’

Although we park owners spend our days worrying about broken septic lines and chatty old ladies, our business is part of the broader web of the financial markets. The VIX, or the Chicago Board Options Exchange Volatility Index, is part of that market, and the VIX is acting strangely now. Should park owners take note? Many people don’t know about the VIX. Much of that ignorance is due to shame. This post is an attempt to shed light on a topic that has hitherto only been discussed in furtive whispers, back-alleys, schoolyards, nudges and winks, and to tie it back to the mission of providing clean, safe and affordable housing for people who need it.

The VIX

The VIX is an index that measures implied volatility in near-term options on the S&P 500 index.

An option is a contract that grants the holder the right, but not the obligation, to buy, in the case of a call option or sell, in the case of a put option, an asset (the ‘underlying’) at a specified price (the ‘strike price’) on or before a stated maturity date.

For example – let’s say that Microsoft is trading at $98 per share. A May 100 call option would grant the holder the right to buy a certain number of shares of Microsoft for $100 per share on or before an expiration date in May. A May 100 put option would grant the holder the right to sell the same number of Microsoft shares for $100 per share on or before the same date in May.

Q: You know that Bill Gates named his company after his penis?

A: Mrs. Maisel will be here all week, folks.

Two parties, i.e. the holder and the issuer enter into each option contract. In the example above, the holder has the right to buy or sell the underlying at the strike price on or before the maturity date. The issuer is the party who is obligated to sell or to buy, if the holder exercises his or her rights. The issuer will not obligate her- or himself under the contract for free. She or he has to be compensated for entering into the contract. The method by which an option issuer calculates the cost of obligating him or herself under an option contract is called option pricing.

An option can have two types of value, i.e. intrinsic value or option value. Intrinsic value is the value that the holder would get if she or he exercised the option immediately. For example, if Microsoft is trading at $100 per share, a Microsoft 98 call has an intrinsic value of $2 per share. This is because, if the holder were to exercise her rights under the call, she could buy a share of Microsoft from the issuer for $98 and immediately sell that share for $100. By contrast, a 98 put would not have intrinsic value, because a rational actor would not buy a share of stock for $100 and then exercise his right to sell it for $98 per share at a $2 loss. However, were the price of Microsoft to drop to, say, $96 per share, the call would lose its intrinsic value and the put would gain $2 in intrinsic value.

Options with intrinsic value are said to be ‘in-the-money’. Options without intrinsic value are out-of-the-money. Options whose strike price is the same as the underlying’s market value are at-the-money.

Calculating intrinsic value is simple subtraction. A junkie can do it (many in my parks do). The difficulty is calculating option value, i.e. the component of option price other than intrinsic value. In order to price option value, a formula must evaluate the following five inputs:

- Time to Maturity Longer-dated options are worth more than shorter-dated options. This makes intuitive sense; you would pay more for the right to buy a hundred shares of Microsoft for $100 per share any time between now and January, 2035 than you would to do the same any time between now and tomorrow morning.

Because longer-dated options are worth more than short-dated options, an option is a wasting asset. As an option’s maturity date nears, it loses option value.

- Moneyness The closer to the money, or the farther in-the-money, an option is, the more valuable it will be.

- Interest Rate and Dividend A holder’s cost of funds and the dividend rate on the underlying both need to be factored into option price.[1] This is because the holder of a call option has the right to appreciation in the value of the underlying without incurring financing charges, without the benefit of receiving dividends prior to exercise.

- Volatility Options on assets with high volatility are worth more than options on assets with low volatility. This is because an option provides its holder the right to profit from potential swings in the value of the underlying. The larger the swings, the greater the option value. The smaller the swings, the smaller the option value.

Volatility is where the rubber meets the road. That is because the volatility is different from the other four inputs. Moneyness and time to maturity are known on the pricing date. Interest and dividend rates may vary between issuance and maturity, but not to a large degree, and anyhow these two inputs are not weighted as heavily as the other three inputs. Future volatility, by contrast, is heavily weighted, and is not known on the pricing date.

Volatility is measured in units of variance and standard deviation. The variance of a population of data is the average of the squares of the differences between each data point and the mean of the data points. The standard deviation is the square root of the variance. As I understand it, the values in the variance are squared to get rid of negative numbers, and the standard deviation is radixed for it to be in the same units as the mean. Variance demonstrates how widely data points in a set as a whole vary from the mean, while standard deviation is used to measure the distance from the mean of any given data point. I believe that this is why most option pricing formulae use variance, rather than standard deviation, as the volatility input.

The volatility value that is plugged in to an option pricing formula is not the variance in, say closing prices of the underlying over the past thirty days. That is the option’s historical volatility. Instead, it is the expected future volatility over the life of the option. Expected volatility can differ significantly from historical volatility. For example, traders might expect a stock with low historical volatility to swing wildly in the wake of an earnings report; because of this, they will plug a higher-than-historical expected volatility into their option pricing formulae prior to earnings releases. Expected volatility rises whenever market uncertainty increases, such as in the wake of wars and terrorist attacks, or in anticipation of presidential elections or legislative changes.

To historical volatility and expected volatility, add the concept of implied volatility. Implied volatility is the value you get if you take actual option prices, actual moneyness, time to maturity and interest and dividend rates and solve for volatility. Implied volatility is the expected volatility that a trader would have to plug into her option pricing formula to produce a theoretical option price equal to actual prices. It is the secret sauce that has to be there, for the burger to taste the way it does.

The S&P Index is a basket of five hundred stocks. Options on the S&P index trade on the CBOE. The VIX is an index that tracks implied volatility in those options. When S&P option values increase, after you strip out extraneous factors, the VIX goes up. When they decrease, it goes down.

That’s the VIX.

Fear Index

The VIX is sometimes called the Fear Index. That is because the VIX tends to go up when fear in the market goes up. It subsides when the market is complacent.

In a rational world, i.e. a world consistent with option pricing formulae, that would not be the case. That is because volatility is not directional. A stock’s performance can have a high variance while its moving average is increasing or decreasing. However, there is a strong negative correlation between the value of the S&P 500 index and the VIX. This is because of a quirk of the equity markets and the way most traders use options.

Equity markets have a long bias. Most equity traders buy shares of stock to hold them. While some traders engage in short-term scalping strategies and other traders enter into short positions that gain value when the applicable asset decreases in price, the lion’s share of capital is committed to long-term long positions. The big players – money managers, pension funds, 401(k) custodians – buy shares and sit on them.

A trader can enter into an option position for one of two purposes, i.e. to hedge or to speculate. The simplest way to hedge a long position is to buy a put. So, when the market thinks that equity prices will tank, puts get bid up. Because of a phenomenon called put-call parity, when put prices increase, call prices also rise.[2] This means that when the market expects a fall in equity prices, option prices increase. When option prices increase, implied volatility increases. The VIX measures implied volatility. So, when the market fears a downturn in equity prices, the VIX increases. That’s why it is called the Fear Index.

Trading Patterns

In addition to a general negative correlation between the VIX and equity indices, the VIX and VIX-related products exhibit two patterns

- Spikes Unlike equity markets, the VIX does not trend. Instead, it spikes and reverts to the mean. A chart of the S&P 500 index of a given time-period could look like a gentle sloping line, peaks and valleys, a cup and a handle, or a head and shoulders. The chart of the VIX, buy contrast, will usually look like the teeth on the blade of a saw. The VIX tends to find a level and move sideways. When a big, fear-inducing event happens (a terrorist attack, say, or a pandemic), it spikes – but it usually returns to its prior level after the market digests the fear-inducing information; and,

- Contango The VIX is not itself an asset, but many assets reference the VIX. Options and futures on the VIX trade on the CBOE. Futures on options on the VIX also trade on the CBOE. Exchange-traded funds (ETFs) and exchange-traded notes (ETNs) reference futures on the VIX.

Q: You mean – you can enter into an option on an ETF that enters into options on futures on an index that references options on equities? That derivative is five levels deep!

A: Only in America.

Futures on the VIX suffer from contango. Contango is a phenomenon whereby the futures price of near-month contracts is lower than that of farther-dated contracts. This occurs in all futures on underliers that have a significant cost of carry, but it is more pronounced in the case of VIX contracts than it is in the case of, say corn or soybean contracts. VIX ETFs and ETNs gain exposure to the VIX by entering into futures contracts on the VIX. Since these contracts have a limited maturity date, they continually exit near-month contracts as these contracts expire and roll into farther-month contracts. Because these contracts decrease in value as they approach maturity, this means that the value of these ETF’s positions falls over time. So – unlike the cash VIX, which does not trend and tends to revert to the mean, VIX-referenced ETFs and ETNs tend to trend downward.[3]

Option Skew and Predictive Power

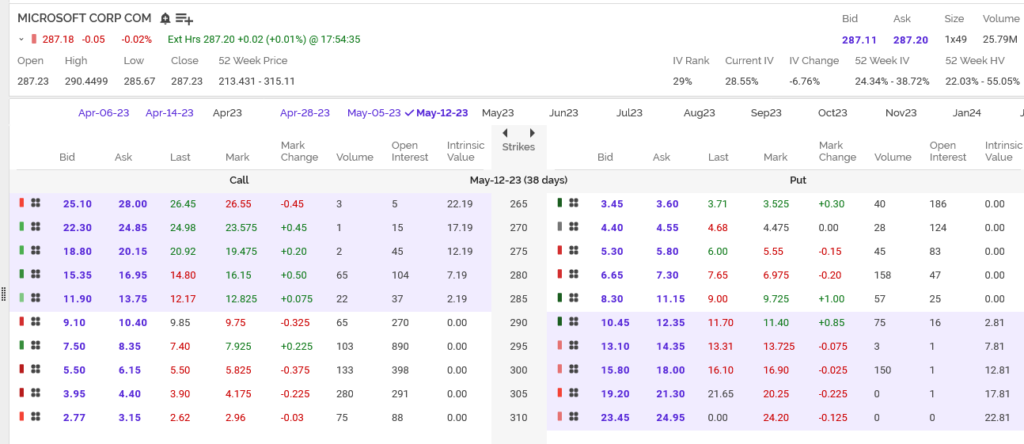

Option prices are quoted in chains, or ladders. For any given expiration, put prices are listed on the right and call prices are listed on the left. At-the-money options are near the center of the screen. In-the-money options are shaded and out-of-the-money options are not shaded. For example, Table 1 shows an option chain for May 12 near-the-money Microsoft options:

Table 1:

In ordinary conditions, out-of-the-money puts trade for roughly the same amount as equally far out-of-the-money calls. That is because, so long as the market does not know whether an underlying asset will increase or decrease in price over the life of an option, traders will pay an equal amount for the right to benefit from the slice of probabilities on either side of the current price.

In certain cases, option chains exhibit a skew between the prices of out-of-the-money puts and calls. If OTM calls are trading rich to OTM puts, that indicates that market participants expect the underlying to increase in price. If OTM puts are priced higher than equally OTM calls, that means that the market expects the price of the underlying to fall.

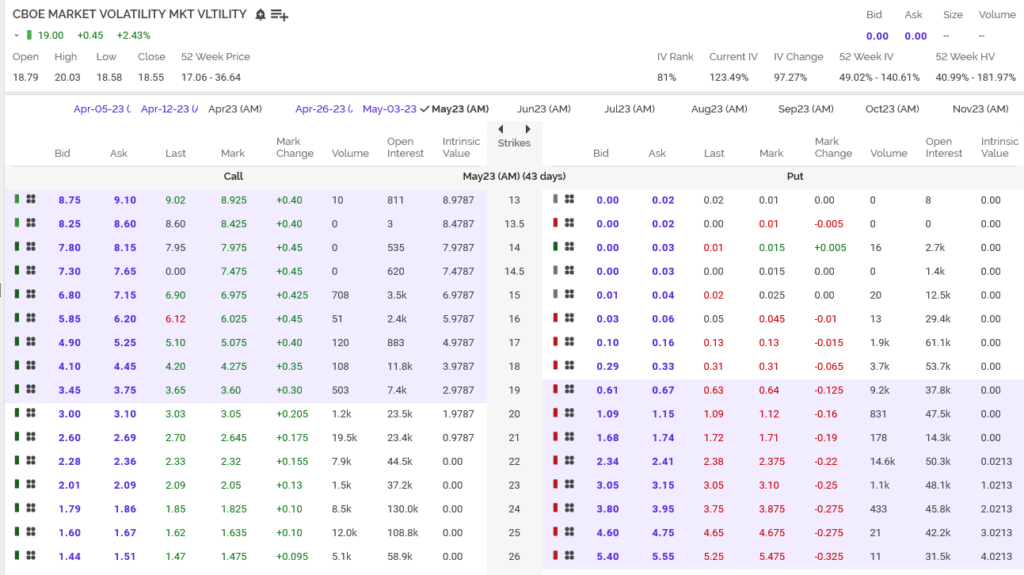

Current VIX options prices exhibit massive skew. Table 2 shows an option chain for near-the-money May VIX options. Out-of-the-money calls are trading at significant valuations, while OTM puts are trading for peanuts. Reader – look at the skew and weep:

Table 2

This means that traders expect the VIX to increase in the short- to mid term. Remember that the VIX is the Fear Index. An increase in the VIX itself would indicate an increase in current fear in the market. An increase in the value of calls on the VIX indicates an increase in the fear of fear itself.

The sentiment indicated by this skew could be self-fulfilling for two reasons. First, we live in a highly-correlated world. The VIX is correlated with equity markets, which are correlated with interest rates, which are correlated with commodities. The traders who are betting that the VIX will rise need to buy their calls from counterparties. Those counterparties need to hedge their short call positions. Since the VIX corelates negatively with equity markets, some of those counterparties will hedge with short positions in equities. Those short positions could weigh on equity markets.

Second, the market is a game of chicken. When investors see people rushing for the exit, everyone joins in and it becomes a mad crush. Sophisticated investors betting that the VIX will spike could be the first people trying to exit the burning theater.

You read it here, folks. Equities will either rise or fall in value in the near-to-mid term. But the skew in VIX prices is one factor that might indicate weakness.

Consequences for the Manufactured Housing Industry

A fall in the equity markets will have consequences for the manufactured housing sector for two reasons, i.e., it might affect the amount of money available to invest in parks and it will affect interest rates.

I will punt on the issue of whether a hit to the stock market will reduce the amount of capital to be invested in manufactured housing. One would think that it would reduce capital to be deployed to the space because it would the total amount of available money. But it also might give investors an incentive to take their money out of equities and put it into something less volatile. I am out of my depth in this regard, and would welcome comments from readers who are realtors as to whether investments in parks are positively or negatively correlated with the stock market.

A hit to the equity markets will affect interest rates. This is of primary importance to park owners, because a mobile home park is an interest rate arbitrage play. A park owner’s business model is to borrow at a rate that is lower than his or her cap rate. A park with an eight percent cap rate can be profitable, if the owner’s cost of funds is four percent. It is much less profitable if the owner borrows at seven percent. When a park owner evaluates a potential deal, she plugs several inputs into her pricing formula. Regulatory restrictions, junkies, Orangeburg pipe, water softeners and lift station repairs all go into the mix. But the most important input is the interest rate. Interest rates are to parks what volatility is to options.

From March 2022 to March 2023, the Fed raised the fed funds rate, the target rate for overnight interbank loans, from .25% to 5%. Over the same period of time, average rates for thirty-year fixed mortgages for single-family homes went from below four percent to six and a half. Rates were raised to combat inflation. The idea is that, as money becomes more expensive, investment will cool and the rate of change of prices will decrease. Although the Fed does not admit to wanting an economic downturn, a recession would solve the inflation problem. The art of money supply management is taming inflation while allowing for a relatively soft landing.

As discussed above, the skew in VIX option prices could indicate near-term weakness in equity markets. A hit to the stock market by itself could cause the Fed to stop its interest rate squeeze. If a decrease in equity prices has knock-on effects with significant Main Street consequences, that could cause the Fed to start lowering interest rates. As rates fall, park prices will increase. So the skew in VIX options might be a harbinger of good news for park owners looking to sell in a year or two’s time.

Or – it might not. You read it here, folks.

[1] I believe that, for these purposes, the cost of storing an underlying, in the case of an option on a physical asset, like gold or oil, is treated as a negative dividend.

[2] Put-call parity is an example of the way in which the market abhors arbitrage. If call prices are not in parity with put prices, traders can profit from a riskless position consisting of a natural position in the underlying and an offsetting synthetic option position. As traders see an opportunity for riskless gain, they flood into these positions, the cheap leg of the position gets bid up, puts and calls achieve parity, and the opportunity for arbitrage evaporates.

[3] By contrast, ETFs and ETNs that provide inverse exposure to the VIX tend to trend upward over time, because they benefit from contango.