Here’s a text conversation I recently had with a guy who scraps homes in my park in central New York. A very good tenant just moved out of a park-owned home and bought another home in the same park. The home they moved out of is a crappy 1978 single-wide with a leak nobody can find and a haunted electrical system. Before the park bought it, it belonged to a woman whose fourteen year-old nephew raped the next door neighbor’s baby son – but that’s a different story. It is usually a good idea to keep a tin can of a home in place, instead of undergoing the expense and headache of upgrading a pad and bringing in a new home, but this particular home breached the Laffer curve when I realized that it did not have a HUD plate, a manufacturer’s sticker, or an installer’s certificate. That was when it became clear that, although the transaction costs associated with replacing the home will be high, keeping it on the balance sheet will be more expensive. So, I asked the maintenance guy at that park to remove the appliances and windows and store them in the pole barn, and then I texted the scrapper, who I will call Geoff:

Mr. Chaucer. It is me, owner of Jollity Estates. I would like to scrap a home. Please let me know if you would like the job.

Morning. Willing to do demo. Will need dumpster. Can start Monday. Gas and electric and water must be off before starting. Also please have permits in place. Thank you

Excellent. Please give me a price.

Hard to do with all the cat mess underneath. Safely say under 2200. Due mainly to labos [sic] cost

That made me snarf my pumpkin-spice almond-milk latte all over the seat of my new red Tesla S. I responded,

Last time was $1,000 firm, for a bigger mess. I understand that costs have gone up, but they have not gone up that much.

And i lost my ass on that one. Since then I charge more. Give big number and people happier when lower.

I googled ‘mobile home scrap central New York’ and typed back,

Let’s find a number that works for both of us. The budget is $1,000, but I can go over a little, to account for inflation since then. 2.2x last price is not possible.

Believe last one for Oscar [another local park owner – eds] was 1900.

I could make it work for $1,500, which is a 50% bump – very generous, for any business. Any price would have to be a firm number or cap.

I get back with you after I talk to my help

Of course. Thank you.

Half a day passed. Near dinner time, my phone farted:

Evening. After talking to guys best they will do it 1600.00. Let me know.

$1,600 it is. Thanks.

Get a dumpster and we start Monday

Done.

Prices have gone up recently. The most recent year-over-year aggregate CPI is 8.2%. Aggregate annual CPI breached 9% in July of this year. It was 5.39% a year before that. Year-over-year, food is at 11.2%, energy is at 19.8%, shelter is at 6.6%, and services less energy is at 6.7%. And CPI is a one-way ratchet that compounds. If CPI were to go down to, say, 2% next year, that doesn’t mean that prices would go down. It would just mean that the rate of growth would slow. We would be stuck with last year’s increases. So if the cost of bread tracked aggregate CPI, a loaf of bread that cost $100 in July of 2020 would cost $105.39 in July of 2021 and $115.06 in July of 2022. If year-over-year CPI were to fall to pre-2020 levels in 2023 – say, to 2% – that loaf of bread would cost $117.37 in July of 2023. That is a smaller percentage increase than that of the previous year, but it is still larger than 2022. So Geoff’s labos costs won’t go down if inflation comes back in line with historical trends. They will just increase at a slower pace.[1]

With miderm elections the week after next and MAGA hooligans nipping at the current administration’s heels, inflation is top of mind for the government. To control inflation, governments can do two things. They can impose price and wage controls, or they can tighten the money supply (I understand that they can also tweak reserve requirements for banks, but reserve requirements are currently at zero). Wage and price controls are the nuclear option. The last time the government imposed an over-arching wage and price freeze, Nixon was in the White House and I was in grade school. Since then, the fed has tightened money supply by raising interest rates. They do this by nudging the fed funds rate (i.e., the rate at which banks lend to each other overnight), by increasing the discount rate, or the rate charged on loans by the Fed to commercial banks, and by adjusting the amount of Treasurys in circulation. None of these directly set the rate that you or I will pay on, say, a car or home loan, but their ripple effects serve to adjust the rates that we pay.

Until January of this year, the Fed Funds rate was below 0.5%. To counteract inflation, the Fed began to raise it. Right now, it is at 3.25%. That has had a pronounced effect on ‘real’ interest rates. I have not been able to find historical data regarding mobile home park financing rates, but rates for loans backed by manufactured housing communities tend to correlate with rates for loans backed by other types of real estate. A year ago, the average rate on a 30-year fixed loan secured by a mortgage on an owner-occupied single-family home was 3.01%. Today, it is 7.08%. Rates on mobile home park loans have moved accordingly.

Residential real estate is an interest arbitrage play. You borrow at four percent to buy a park with a cap rate of eight percent and a cash-on-cash return of fifteen percent. You make money from the difference between your net income and your cost of funds.[2] What this means is that, as interest rates rise, park prices take a hit. A six-cap park may look pretty good if you can finance it at a three percent interest rate. It does not look so great if you have to borrow at seven percent. But if the seller reduces the price to a level that yields a ten-cap, then the deal looks better – for the buyer.

So – when interest rates go up, park values go down.

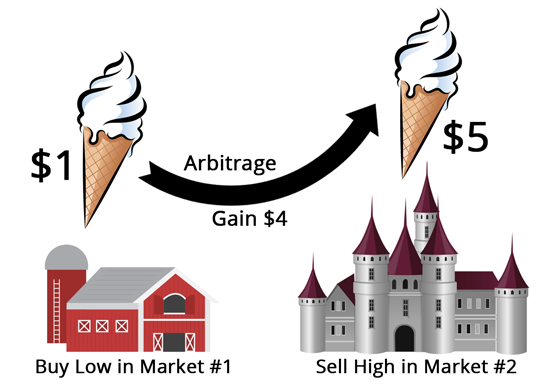

I have written about Arbitrage before. Arbitrage is riskless gain. When hot dogs are selling for a dollar in Brooklyn and a dollar five in Manhattan, you place an order to long a hundred Brooklyn dogs and short a hundred Manhattan dogs simultaneously. The five dollars you pocket are the wages of arbitrage.

Arbitrage opportunities disappear quickly. Once everyone knows that hot dogs are selling cheaply in Brooklyn, they will bid up the price of Brooklyn dogs and dump over-priced Manhattan dogs. Equilibrium will be reached when the price of Brooklyn dogs is the same as that of Manhattan dogs, after storage, transportation, lawyers’ fees and other transaction costs are taken into account. It sounds like a cumbersome process, but in the electronic markets, where everything is powered by algorithms, the invisible hand works its magic in the blink of an eye.

(Before I began to earn an honest living, I was a tax lawyer. Among other things, I helped bankers and money managers design tax products. Many of these were so-called tax arbitrage plays. These were entities, instruments and holding arrangements that were one thing for American tax purposes but something else for, say, Australian tax purposes. The result was a double- or triple-dip tax benefit (think a payment from a US entity to a Mexican holder that is deductible here but excludible on the other side of the border). I interviewed for a job with a large commodity producer based in Minneapolis once. One of my interviewers was a trader originally from Chicago. Since he was a trader, he referred to arbitrage as ‘arb’, and since he was from Chicago, he referred to tax as ‘tyex’. He uttered the noun phrase ‘tyex aerb’ no more than five times during our conversation, but the scratches that it wore into my neural pathways have lasted until now.)

A mobile home park is a stream of cash flows.[3] The value of a stream of payments reaching into perpetuity is C/r, where C is cash flow and r is the discount rate. So, if you have a bond that will pay $100 until Judgement Day and the discount rate is 5%, that bond is worth $2,000. In the case of a growing perpetuity, i.e., a perpetual bond on which payments will increase by a rate, say, ‘i’, the value of the bond is C/(r-i). So if a bond were to pay $100 annually on Day 1, the coupon were to increase by 2% each year, and the discount rate were 5%, that bond would be worth $100/(.05-.02) = $100/.03 = $3,333.34.

As interest rates rise, the number for ‘r’ that you plug into the denominator increases. As the value of the denominator increases, the value of the fraction that represents the value of future payments decreases. So– when interest rates rise, park prices get whacked.

It gets worse, of course. Rent control is a type of price control. Parks in New York State are subject to rent control. So, park owners in New York are subject to price controls while our suppliers, like Geoff, can increase our costs without limitation. That puts the squeeze on us. Since price controls operate independently of rate hikes, this means that we feel this squeeze in addition to the hit that we take to our net worth when interest rates jump.

So, passengers should expect short-to medium term turbulence. But it is not all bad. The longer-term prospects give reason for hope. Even with the specter of regulatory risk haunting North America, long-term trends are favorable. The parks constitute ninety-seven acres of land that pay for themselves in the Northeast, near large bodies of fresh water. Florida will be submerged in twenty years. Texas, Arizona and the rest of the Southwest will suffer from sustained temperatures above the wet-bulb threshold. Fires will devastate the Pacific Northwest and the Mountain West. The Northeast and the area around the Great Lakes will be the only habitable parts of the country. And interest rates fluctuate. What goes up comes down again. The best time to sell is either last year or ten years hence. I am still young enough to be shot by a jealous husband. I can certainly hold on for another ten years.

When I googled alternatives to That Greedy Bastard Geoff, I came across the website of an organization called Banyan Home Removal. They are a charitable organization based in Texas but operating nation-wide. If you are a park owner with a 1980 or more recent home that you would like to get rid of, they will take that home off your hands for free and give it to a person who needs housing. I could not use their services this time because the home I wanted to scrap was a 1978, but I will keep them in my contacts. Their services are free. ‘Free’ means that they do not jack up their prices willy-nilly, like certain scrappers. And, when you donate your home to them, you get a charitable tax deduction. If it were possible to pair that with the receipt of a cash payment, that would be a great tax arb play.

[1] ‘Labos’ was a typo in Geoff’s text, but it has historical precedent. The English ‘labor’ comes from the Latin labor which means, well, ‘labor’. There is a class of Latin third-declension nouns in which, in the classical period, the nom. sg. ended in -or and the gen. sg. in –oris. These include, inter alia, labor, laboris, color, coloris and honor, honoris. In more archaic Latin, the nom. sg. of these nouns ended in –os. In the indirect cases, intervocalic s became r. and, eventually, the nominative followed. Thus, in older texts, you see, e.g. labos, laboris, colos, coloris, honos, honoris.

[2] Cap rate is net operating income before debt service, divided by purchase price and start-up costs. Cash-on-cash return is net income after debt service, divided by your down payment and start-up costs.

[3] For completeness, we should note that a mobile home park is, in fact, two things at once. From the owner’s perspective, it is a stream of cash flows. From the residents’ perspective, it is the place where, when you have to go there, they have to take you in. This is a paradox that every owner and every resident has to navigate. See, e.g., Kaufmann, Particle or Wave: on Esther Sullivan’s ‘Manufactured Insecurity’, Cl. Rev. Bks, https://www.clereviewofbooks.com/home/esther-sullivan-manufactured-insecurity-review

O.K. WHAT IS THE POINT OF THIS ESSAY ?

It will make you richer and more attractive to women.

Awhile back, after giving up on trying to teach me how repo works, someone sent me a journal article called “Caveat Re-Emptor.”

That has been my favorite piece of scholarly tax writing ever since. I mentioned it to a financial products tax lawyer and he pointed me to this blog. It is delightful.

Thank you for taking the time to write with such care and wit and congrats on no longer being a repo man.

Thank you for the kind words, Herr Doktor.